Not known Factual Statements About Special Assessments Florida

Table of ContentsSpecial Assessments Florida - The Facts7 Easy Facts About Special Assessments Florida ExplainedSpecial Assessments Florida - TruthsThe Best Guide To Special Assessments FloridaThe Single Strategy To Use For Special Assessments Florida

An unique assessment is a levy that property owners organizations or local governments occasionally bill homeowners under specific conditions. The money may be utilized to spend for repair services, installments or other community-related construction or upkeep costs that can not be covered by the existing operating budget or money books. There are 2 kinds of unique assessments one that is billed by a property owners organization (HOA) and one that is billed by communities.This cash is generally utilized to cover the expense of regular upkeep of community facilities, landscaping and sometimes also water as well as trash bills. An HOA (or co-op board, in the situation of co-operative structures) may occasionally impose what's known as a special analysis that is separate from month-to-month home owners charges.

When unique analyses arise, the HOA may need home owners to pay the fee in one swelling amount or it may tack on a little added to the regular monthly home owners charges until the unique analysis is fully settled. The authority to impose these assessments is commonly described in the HOA Covenants, Issues as well as Restrictions (CC&R s) record.

Unique evaluations are usually imposed in an emergency situation when something in the area breaks or a big unexpected expenditure happens. They may additionally be credited cover the expenses of more considerable or infrequent maintenance tasks if an HOA does not preserve a sufficient reserve fund to cover such infrastructure or maintenance costs (special assessments florida).

Special Assessments Florida Can Be Fun For Anyone

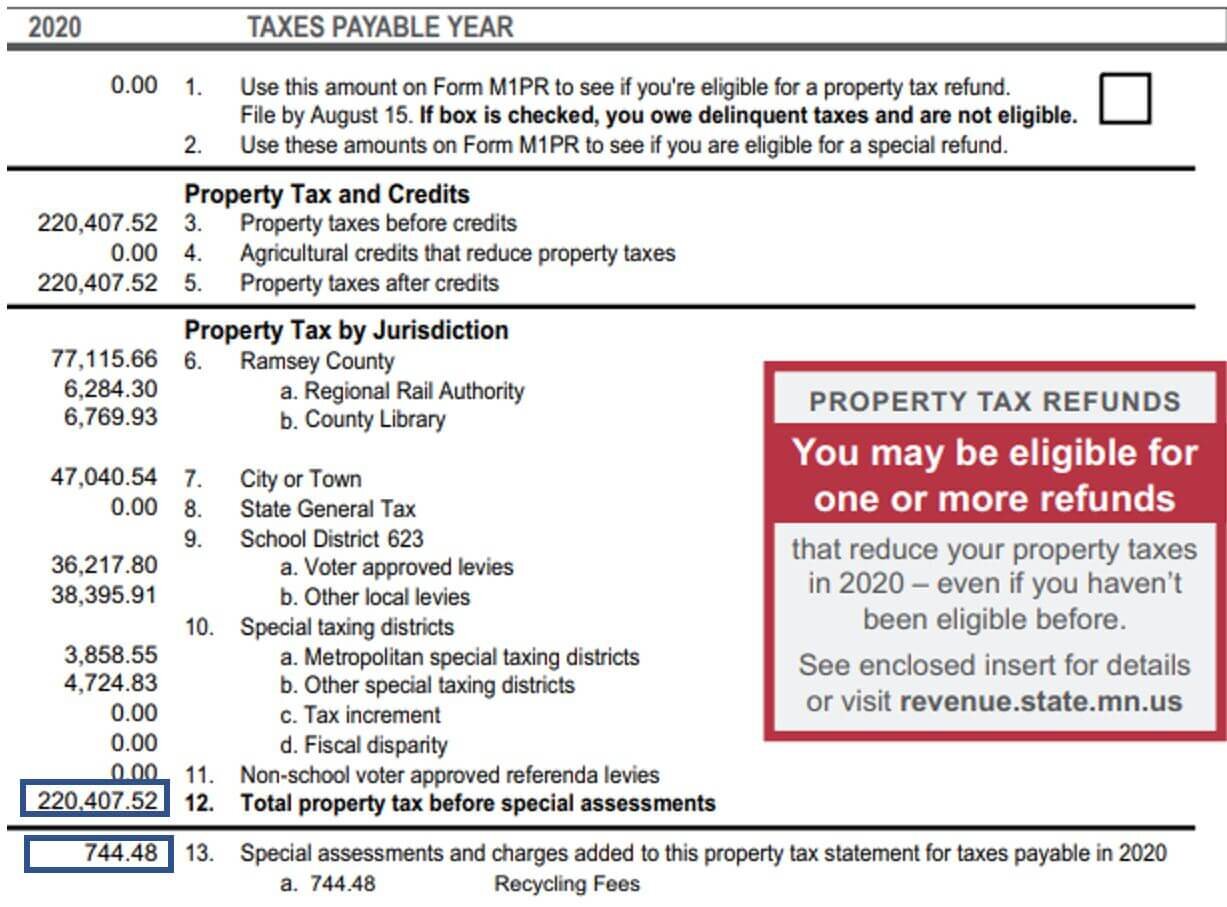

Unique analyses billed by an HOA are various then an unique assessment tax obligation. As a home owner, you will need to pay standard home tax obligations to the city government. Occasionally, your city government might likewise charge a special assessment tax obligation along with your real estate tax, in order to pay for neighborhood tasks.

Instances that might involve a special analysis consist of drain and water supply work, updating as well as preserving roads as well as sidewalks, setting up park drains pipes or other public energy projects. Just locals that will take advantage of these upgrades or enhancements will certainly be taxed. On top of that, these tasks typically boost the value of the actual estate in area, which can profit the house owners funding the unique assessment.

Special Assessments Florida - Questions

While variations of the idea of Discover More unique assessments have actually existed in a number of the world's countries since the 1600s, in the United States an unique analysis is extra officially defined through court activity as compensation that a governmental device might demand from property owners to fund a public project which creates a "benefit" in residential properties existing within a special geographic area recognized as an unique evaluation district.

Circumstances vary according to regulations of different states, yet the necessary distinguishing attribute between these 2 sorts of districts is this: a solution district is made up of all individual parcels of land that are in some way linked to the public renovation for which the unique evaluation is to be imposed. The unique evaluation district includes just those properties which are marked by the applicable legislation as having actually obtained a details and also one-of-a-kind "advantage" from the public renovation.

In the situation of a dam .. - special assessments florida. all homes located within a medically specified "landmark" and also all homes existing within the floodplain of the dam are attached by how water drains from an entire watershed right into a lake and also how water within the lake may flood particular areas downstream. Since the location of a watershed as well as the area of a floodplain are usually very, large when compared to the area of a lake, it is possible for some sections of the landmark and floodplain to be physically located in some government system aside from the lake.

In this example, the service area would certainly be big sufficient to include all buildings linked to the lake by how water flows. The Special Assessment District would be a smaller area within which the federal government device proposing the unique assessment has the power to impose an unique analysis tax. When it comes to an economic growth job (e.

Some Ideas on Special Assessments Florida You Should Know

a investigate this site vehicle parking framework for an organization district) scenarios which would trigger the solution area and also S.A.D. to have differing geographical borders associates with the existing and also allowed use of property as opposed to political subdivisions. That is, financial forces within the market would certainly be the key to consisting of or excluding a particular property (special assessments florida).

An example could be that users of a parking structure will certainly go across an area defined as being within six blocks or much less of a parking structure. In this example, the service area would certainly be composed of all homes existing within six blocks of the auto parking framework.

In general, the "benefit" has to result directly, uniquely and also particularly from the public task. When water as well as sewage system lines are set up by government units, neighboring land usually boosts in value.

The 3-Minute Rule for Special Assessments Florida

Land that might have been "unbuildable" before might come to be "buildable" once federal government gave water and also sewer services come to be offered. Providing water as well as sewer solution are situations which might adapt formerly pointless land for view publisher site household or industrial use. A tornado sewer or a dam or dike may minimize flooding and also consequently the sewer, dike or dam alleviates a worry, flooding.

However, some states historically have actually defined the term benefit to suggest more than an increase in market worth. As an example, advantage might suggest a special versatility of the land or a remedy for some worry. Just particular home can be specially analyzed. The "residential or commercial property" to be analyzed need to be real estate rather than "personalty".

This geographical area is described an Unique Analysis District. In some states, occasionally one federal government system can levy an unique evaluation against an additional. This is true in situations where the public's health and wellness, security and also well-being are being advertised by the job (e. g. repair services to a dam). Refer to particular state laws for details.